The Financing Process

Building a solid foundation for your purchase

Financing is one of the most important parts of buying a home — and one that’s easier when you have the right guidance. Together, we’ll connect you with trusted local lenders who can walk you through your options, answer your questions, and help you find the loan program that fits your goals and budget.

Getting pre-approved early gives you a clear picture of your buying power and helps you act confidently when the right property comes along. It also shows sellers that you’re serious and ready, giving your offer an edge in a competitive Pacific Northwest market.

Throughout the process, you’ll have clear communication and expert support so each step — from pre-approval to closing — feels transparent and manageable. Because the right financing isn’t just about numbers; it’s about setting you up for success in your next chapter.

Step One:

Get Pre-Approval

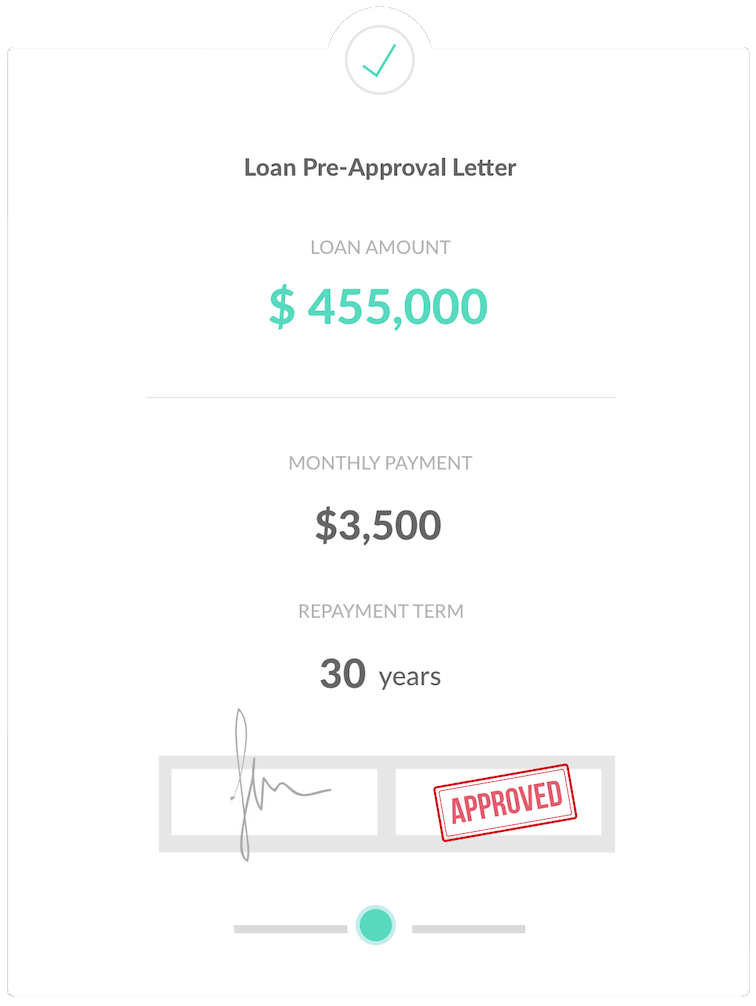

Before you start touring homes, it helps to know exactly what’s possible. Getting pre-approved gives you a clear understanding of your buying power and helps define your budget — so you can focus on the homes that truly fit your goals.

During pre-approval, a trusted lender reviews your finances, credit, and income to determine what you can comfortably afford. It’s quick, straightforward, and one of the smartest steps you can take early in the process.

When you find a home you love, a pre-approval letter also strengthens your offer — showing sellers that you’re serious, prepared, and ready to move forward.

The result? Confidence, clarity, and a smoother path from search to keys in hand.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

Find the best loan

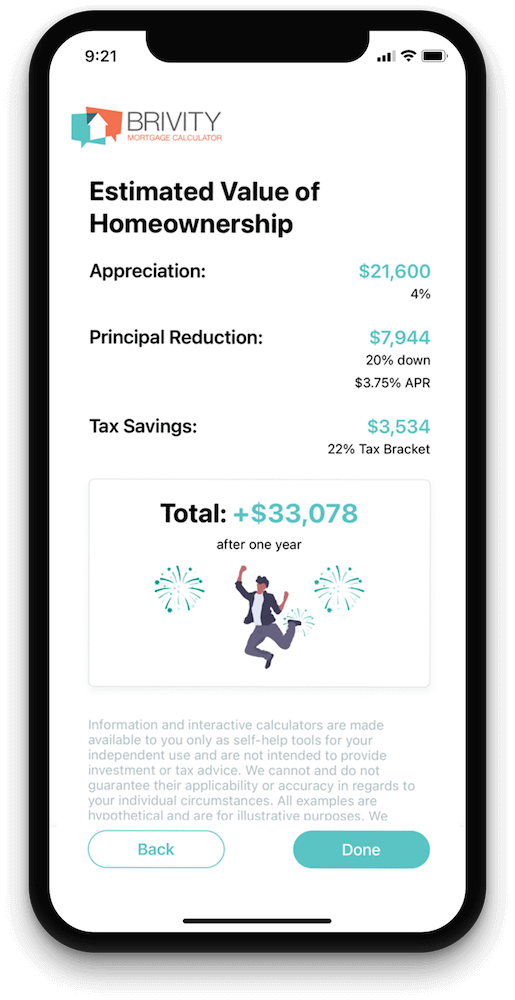

Once you’re pre-approved, it’s time to look closely at your loan options. Every buyer’s situation is different — and the best loan is the one that fits your lifestyle, your budget, and your plans for the future.

A trusted lender will help you compare programs, interest rates, and down payment requirements, explaining the benefits of each so you can make an informed decision. Whether you’re buying your first home, investing in a property, or settling into a second home in the Pacific Northwest, having the right financing strategy makes all the difference.

The goal isn’t just to secure a loan — it’s to find a financing path that feels sustainable, smart, and aligned with your bigger picture. With the right team in place, you can move forward knowing your purchase is built on a strong financial foundation.

Step Three:

Keeping Things Moving - Clearly and Confidently

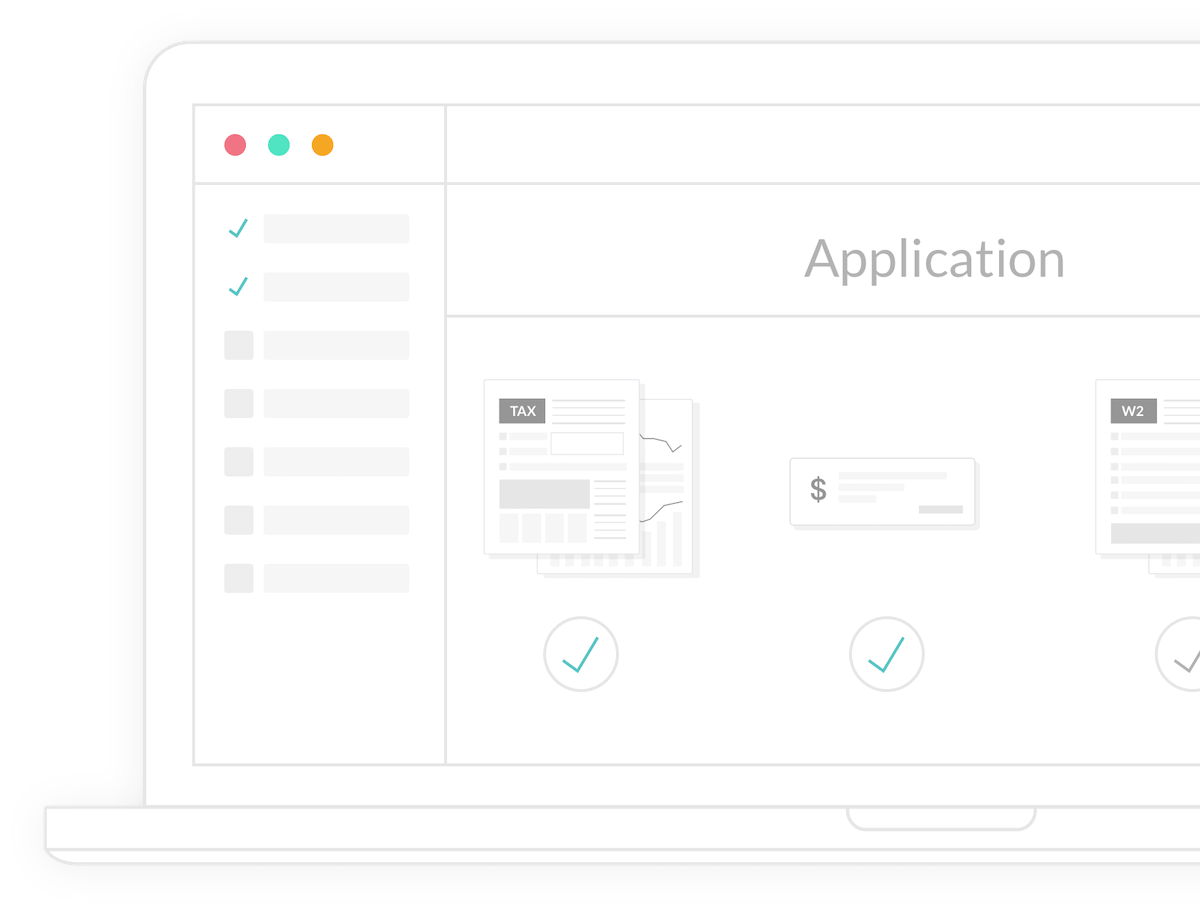

Once you’ve chosen the right loan, your lender will guide you through the formal application process. You’ll provide documentation like pay stubs, bank statements, and employment history so your lender can verify details and move your loan toward approval.

During this stage, communication is key. You’ll receive regular updates as your file moves through underwriting and processing — and your agent and lender will stay in close contact to make sure everything stays on track.

It’s a behind-the-scenes step that can feel complex, but with the right team, it’s smooth and transparent. You’ll know exactly where things stand, what’s next, and when you’re ready for closing — one step closer to the keys to your new home.

Step Four:

Signing and finalizing the deal

Once your loan is approved and all contingencies are cleared, it’s time for the final step: signing your closing documents and officially completing your purchase. Your lender and escrow team will walk you through each form so you understand what you’re signing — no surprises, just clarity.

On closing day, funds are transferred, paperwork is finalized, and the keys to your new home are officially yours. Throughout this process, your agent stays closely involved to ensure every deadline is met and every question answered, keeping your experience smooth from start to finish.

It’s more than just signatures — it’s the moment everything comes together. The planning, the searching, the preparation… all leading to the simple joy of opening the door to your new home.